Understand the Importance of Credit

Stated simply, "credit" is the lending of money over time, usually paid back in monthly installments. Why is credit important? With good credit, your cost to borrow money will be lower, your access to capital greater and your financial stability in the face of emergencies stronger. This adds up to greater financial independence as you go through life.

To borrow money, you usually must pay interest (a fee to borrow the money) which accumulates over time. It is true that getting credit (i.e. loans) helps in building credit because credit-worthiness is the measure of a person's consistency in repaying lenders.

Credit is just one more major building block to achieving financial health. Too many students make decisions during their college years that will haunt them as they move into the adult world. By making smart decisions while in college, you can get yourself off on the right foot as you start your post-college life. "Starting From Scratch: A Simple Way to Establish Credit" (CNBC) offers smart tips and a video on ways to establish credit before you really have any.

your credit report

A credit report is a summary of your credit history and shows how you have managed your financial accounts. It helps lenders determine how responsible you might be as a borrower. You will be assigned a credit score by reporting agencies that monitor your financial activity. Strive for a high credit score the same way you would a high GPA.

A credit report takes into consideration the following kinds of details:

- Personal data (addresses, SSN, employment history)

- Credit history (accounts and where you stand with payments)

- Inquiries into your credit history

- Information on liens, wage garnishes, state or county records

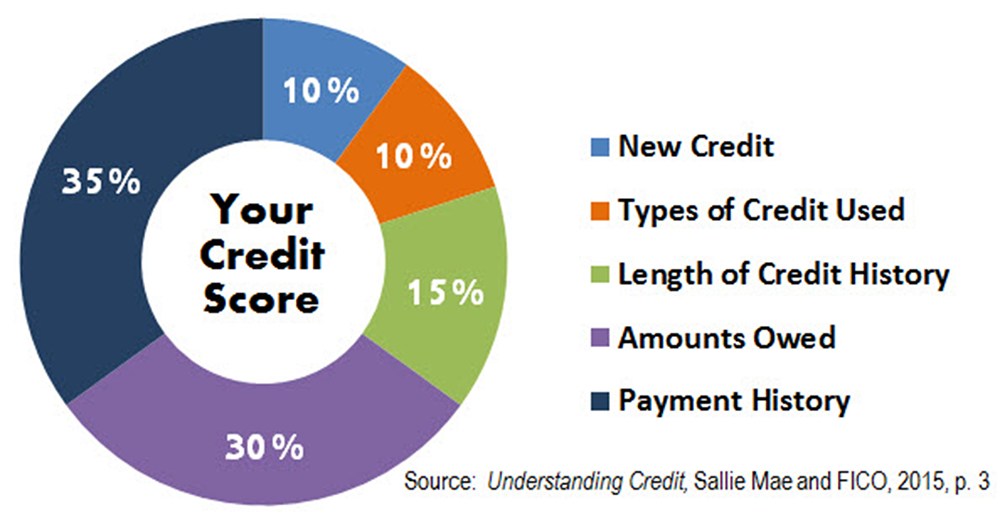

Factors weighing on your credit (and their estimated "weight"):

- New Credit: How much of your available credit is new?

- Types of Credit Used: What is your mix of credit cards, retail credit, student loans, mortgages, etc.?

- Length of Credit History: How long have you been using credit?

- Amounts Owed: How much do you owe and how much of your available credit have you used?

- Payment History: Have you paid your past credit accounts on time?

As you can see, as a college student or new graduate, there are not many things in this list you can control. However, by taking out student loans, making payments on time and avoiding retail credit cards, you can begin to build a healthy score.

Equifax, Experian and TransUnion are three national credit bureaus that have the power to pull your credit report. Visit AnnualCreditReport.com each year to retrieve your free copy. Your credit report will include information on how to dispute any findings you feel are inaccurate. It is important to review your credit report to look for inconsistencies, inaccurate information and instances of possible identity theft. The sooner you can respond to issues you find, the better equipped you'll be to protect your credit.

Protecting & Managing Your Credit

Building a strong credit score takes time, attention and diligence. The best advice for establishing healthy credit is:

- Create a budget and stick to it.

- Make payments on time.

- Keep your balances low and pay balances in full, whenever possible.

- Manage multiple cards carefully and wisely.

- Keep loan debt as low as possible.

- Monitor your credit score and correct mistakes as soon as you find them.

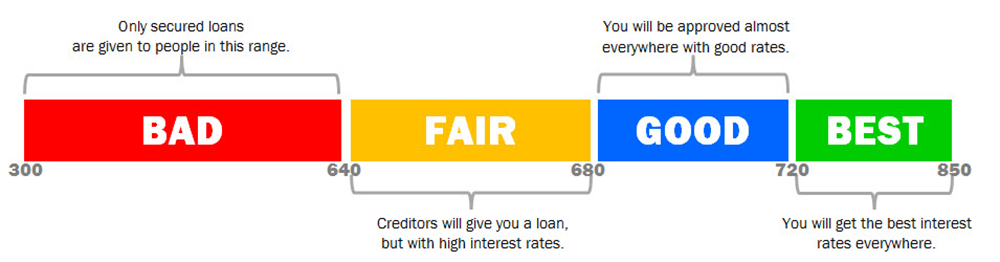

Your credit score determines the level of risk a lender feels you pose. Here's a breakdown of scores and what they mean for you: