About

If you are selected for Verification, UNE will notify you of the documents required. If you are a new incoming student, your financial aid award will be considered estimated until the verification process is complete and your award can be finalized. If you are a returning student, you will not be awarded financial aid until the verification process is complete.

We will begin verifying your file once all required documents are submitted. If further clarification is needed, you will receive a follow-up letter/email explaining what is still needed. To ensure prompt completion of the process and to receive your finalized award letter as quickly as possible, be sure all documents are complete, accurate and submitted in a timely manner. You can submit your documents by email (sfs@une.edu), fax (207-602-5968), or U.S. Mail.

We recognize the verification process can at first seem daunting and time-consuming. That is why we have devoted this section of the website to walk you through this process and provide answers to common questions. If you still have questions, please contact our office.

Completing the Verification Worksheet to Avoid Delays

To avoid delay of your financial aid award, be sure all verification items are complete and ready for processing by carefully reviewing the information below. Incomplete items will be returned to you, postponing your award, so it is imperative to submit all documents as accurately and as quickly as possible upon notification of your selection.

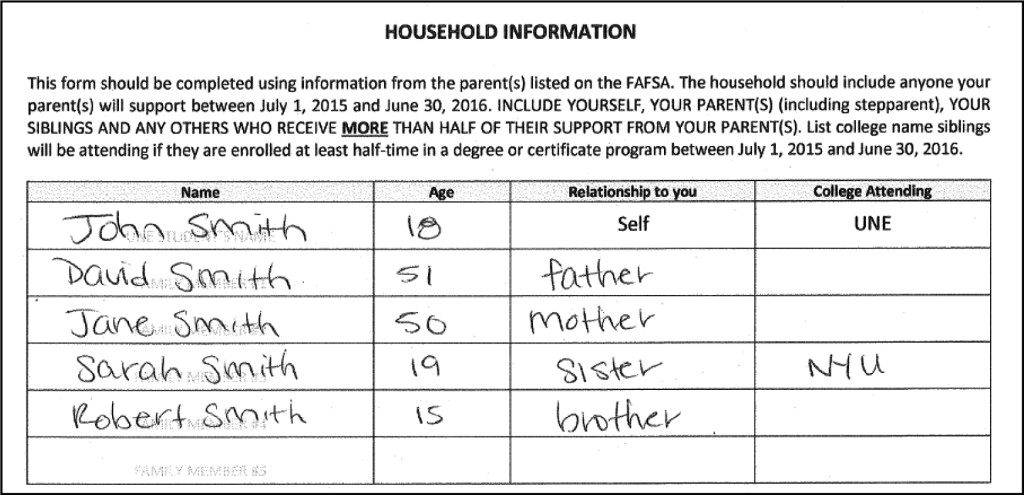

Include Everyone in the Household

For dependent students, you will need to include the student (first line), parents whose data is included on the FAFSA (including stepparents, if applicable), siblings, and anyone else who lives in the household for whom a parent will support at least 50% during the upcoming academic year.

Verification Process Documents

Below are examples of the most commonly requested documents for the verification process. While all forms may not be applicable to you (such as individual schedules), to avoid potential delays and to ensure your verification is processed as quickly as possible, please take a moment to review the documents. If you have any questions regarding what specific documents you may need to submit, please contact our office.

FAQ

Below are some of the most common questions you may have about verification and answers to help assist you. If you do not find the answers to your questions, please contact our office.

Each year students and their families apply for financial aid by submitting a Free Application of Federal Student Aid (FAFSA). Some applicants are asked to provide supporting documents to verify the information reported on their FAFSA through a process called verification.

There are various reasons why your FAFSA may be selected for verification. Perhaps the FAFSA included estimates of federal income tax information and the actual information now must be confirmed. Or maybe the FAFSA was submitted with data that appears inconsistent or unusual, or includes the type of information that is frequently misreported. You may be selected for verification by either the University or the U.S. Department of Education's Federal Processor.

If you are a new incoming student, you will also receive notification of selection in your UNE award letter, which will also detail the documents required. If you are a returning student, an email will be sent to your UNE email address informing you of your selection and what is needed. Both new and returning students can view a list of requirements by visiting your U-Online account. If you are selected by the Department of Education, your Student Aid Report (SAR) will indicate you were selected.

UNE does not have a specific deadline date by which verification documents must be submitted; however, in order to allow for adequate processing time, all required documentation must be submitted no later than four weeks prior to the official end of the current academic year (during the spring semester).

Upon submission of all of the requested documents, it can take up to 7 to 10 business days for your verification material to be reviewed. Please note, during peak processing times verification may take longer. This usually occurs from March through August. To avoid delays and to expedite review and confirmation of your financial aid eligibility, please provide all required documentation as early as possible. Once reviewed, you will be notified of any additional documentation needed. If nothing further is required, your information will be processed and your financial aid award will be completed. Returning students will receive notification via email that they have been awarded and can then view their award through U-Online. New students will receive a finalized award letter by mail.

Typically, we begin awarding our returning students who have completed the FAFSA in mid-April. However, if you are selected for verification, you will not receive notification of your award until all required documentation is submitted and the verification process is complete.

While there are several types of verification that may require different documents, the most common type requires the following forms:

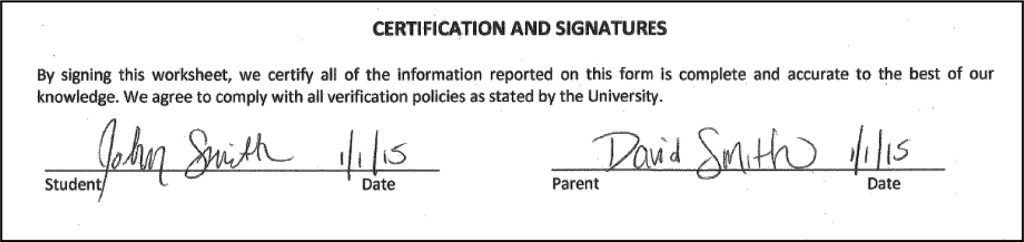

- Verification Worksheet (Dependent or Independent) — Be sure to complete this form completely! If a question does not apply to you, indicate "NA" so we know you read it. This form can be found on your U-Online account.

- Signed copy of Federal IRS Tax Return(s) for both the student and the parent(s) from 2 years prior (ex. 2017 return needed for 2019-2020 FAFSA). You can also use of the IRS Data Retrieval Tool on the FAFSA (if a tax filer).

- All W-2 Forms for both the student and the parent(s)

Regardless of the verification process for which you are selected, we will notify you of all documentation that is required. It is possible that after review of documents submitted, the Financial Aid Office may request additional documents for clarification purposes.

The IRS Data Retrieval Tool (commonly referred to as DRT) is a function on the FAFSA that allows you to directly transfer your tax information from the IRS database into the FAFSA. The DRT can be used when completing the FAFSA or when updating the FAFSA after the IRS has processed your tax return .

Most students and parents can use the IRS Data Retrieval Tool when completing the verification process (or when updating your FAFSA). However, several instances may make you ineligible to use the DRT. Ineligible statuses include:

- Married filing separately

- Filing an amended tax return

- Puerto Rican or foreign returns

- Log into the FAFSA using the student’s name, Social Security Number, and date of birth.

- Select “Make FAFSA Corrections.”

- Enter the student’s FSA ID.

- Select the “Financial Information” tab. For dependent students, the “Parent Financial Information” screen will display and for independent students the “Student Financial Information” will display. Select “already completed” from the drop down box.

- Answer the “Yes/No” questions to determine if you are eligible to use the IRS Data Retrieval Tool. If you are eligible, enter the parent/student FSA ID and link to the IRS. You will be notified that you are leaving the FAFSA website. Click “OK” to continue.

- Enter the requested information EXACTLY as it appears on your tax return, including the tax filing status and address information. Any errors in this information could prevent successful use of the DRT. Click “Submit.” If your information is validated by the IRS, the federal income tax information will display.

- Select “Transfer My Tax Information into the FAFSA,”,= and then select “Transfer Now.” You will then be re-directed back to the FAFSA.

- If you are a dependent student who filed a tax return, you will need to repeat the process from step 5 to use the DRT again.

- Once completed, continue to the “Sign & Submit” tab to fully process corrections and re-submit the FAFSA with the tax information from the DRT.

If filed electronically, once the tax return is processed by the IRS, the DRT is typically available within two weeks. For returns filed by mail, once processed by the IRS, the DRT is usually available in approximately 6–8 weeks.

If you are not able to use the IRS Data Retrieval Tool, you can submit a copy of your signed Federal Tax Return to our office. You are not required to use the DRT and can submit a Federal Tax Return (signed) if you prefer or if you experience any issues using the DRT.

If you have never filed taxes for any previous year:

- Go to www.irs.gov.

- Under “Tools” click “Get a tax transcript.”

- On the right hand side of the page under “Related Forms,” choose “Form 4056-T, Request for Transcript of Tax Return.”

- Under “Current Products,” choose “Form 4506-T.”

- Complete, print and sign the form. Be sure to check Box 7, “Verification of Non-filing.”

- Mail/fax it to the address corresponding to the state in which you live.

- You will receive the letter in the mail and can send/scan it to us.

If you have filed taxes in previous years:

- Go to www.irs.gov.

- Under Tools, click "Get a tax transcript."

- Click “Get Transcript ONLINE” (If at any point, you cannot validate your identity — for example, you cannot provide financial verification information or you lack access to a mobile phone — you may use Get Transcript by MAIL, see above).

- Enter the non-filer’s Social Security Number, email address, filing status, account numbers for loan or credit card associated with your name, and mobile phone associated with your name.

- Click “Continue.”

- Select "Verification of Non-filing Letter” and in the Tax Year field, indicate the year requested.

- If your information is successfully validated, you will be able to view your IRS Verification of Non-filing Letter.

Please note that if you have never filed taxes before, the only option you have to request the letter is by using Form 4506-T. You must complete the form and send/fax it to the IRS address that corresponds with your state. Make sure to also request that the letter be sent to your address directly and not sent to UNE as this may not always work.

Yes, you do! To ensure accurate verification of income and wages, UNE requires copies of all W-2 forms (from both parents, students, and spouses, if applicable) for review during verification.

If a student/family does not provide the verification materials, the verification is incomplete. UNE would be unable to award federal, state, and most types of institutional aid until verification is completed.

If you are missing a W-2, contact your employer for a replacement copy. You can also go to www.IRS.gov to obtain a "Wage and Income Transcript."

In some instances, you may not receive a W-2 for earnings reportable on the tax return. In such circumstances, you must include a written description of the amount and source of income with your verification material and include any supporting documentation you may have regarding this income.

If you or your parents have filed for an extension, contact our office and let us know when you expect to file your tax return. Once your tax return is completed and filed, please use the IRS Data Retrieval Tool as soon as it is available. Be sure to make copies of all tax returns for future reference.

If any conflicting information or discrepancies are found between the materials you provide as part of the verification process and the information originally indicated on your FAFSA, your financial aid eligibility may change and your award would be adjusted accordingly.

Contact

Student Financial Services

For information about the financial aid process call (207) 602-2342 or email Student Financial Services.